Positioning that strikes a chord

Positioning that strikes a chord

Positioning that strikes a chord

An embedded finance startup redefines it’s positioning to boost market expansion and scale impact for small businesses across Africa.

An embedded finance startup redefines it’s positioning to boost market expansion and scale impact for small businesses across Africa.

User journey mapping of merchant and partner steps from awareness, to acquisition, to activation.

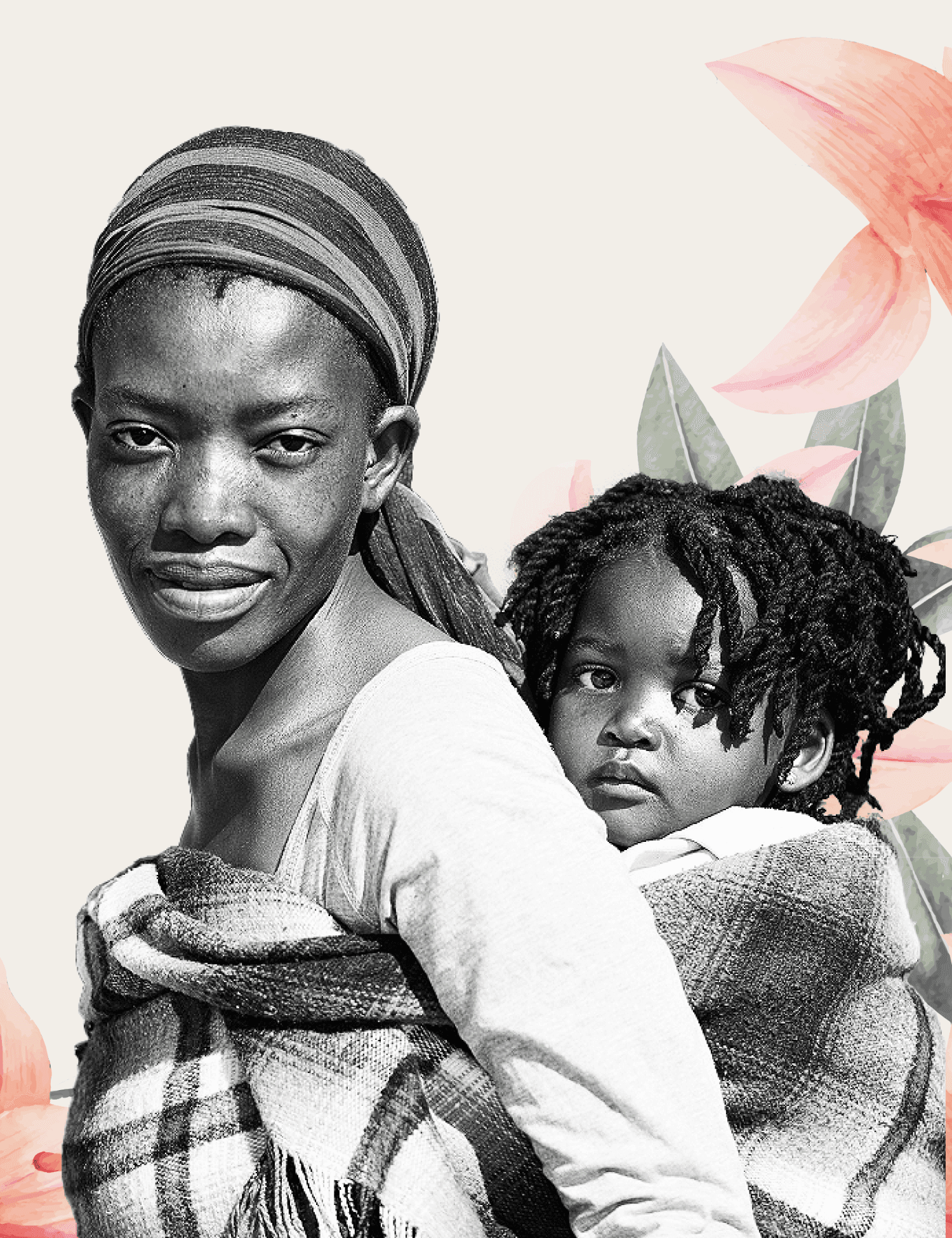

littlefish is on a mission to catalyze positive change in commerce for countless micro, small, and medium-sized enterprises (MSMEs) across our continent. However, as they navigated through years of growth, diversifying their product offerings and expanding their team and resources, their foundational identity and vision became blurred. littlefish needed to redefine their identity around a clear message that resonated both with financial institutions they partnered with, as well as the merchants whose success represented their core purpose. Kumquat worked with the littlefish team to first address the fundamental question, "Who are we?”

littlefish is on a mission to catalyze positive change in commerce for countless micro, small, and medium-sized enterprises (MSMEs) across our continent. However, as they navigated through years of growth, diversifying their product offerings and expanding their team and resources, their foundational identity and vision became blurred. littlefish needed to redefine their identity around a clear message that resonated both with financial institutions they partnered with, as well as the merchants whose success represented their core purpose. Kumquat worked with the littlefish team to first address the fundamental question, "Who are we?”

littlefish is on a mission to catalyze positive change in commerce for countless micro, small, and medium-sized enterprises (MSMEs) across our continent. However, as they navigated through years of growth, diversifying their product offerings and expanding their team and resources, their foundational identity and vision became blurred. littlefish needed to redefine their identity around a clear message that resonated both with financial institutions they partnered with, as well as the merchants whose success represented their core purpose. Kumquat worked with the littlefish team to first address the fundamental question, "Who are we?”

SMEs show an increasing openness to sourcing financial services from non-traditional bank entities.

Embedded payments already has a penetration of ~35% amongst the SMEs that use a platform, up from ~30% in 2021

Leading platforms that pioneered embedded payments are capturing over 80% of their revenue from transactions and are looking to diversify.

During intensive workshops, we meticulously mapped out littlefish's distinct value propositions to crystallize an identity that deeply resonates with their stakeholders.

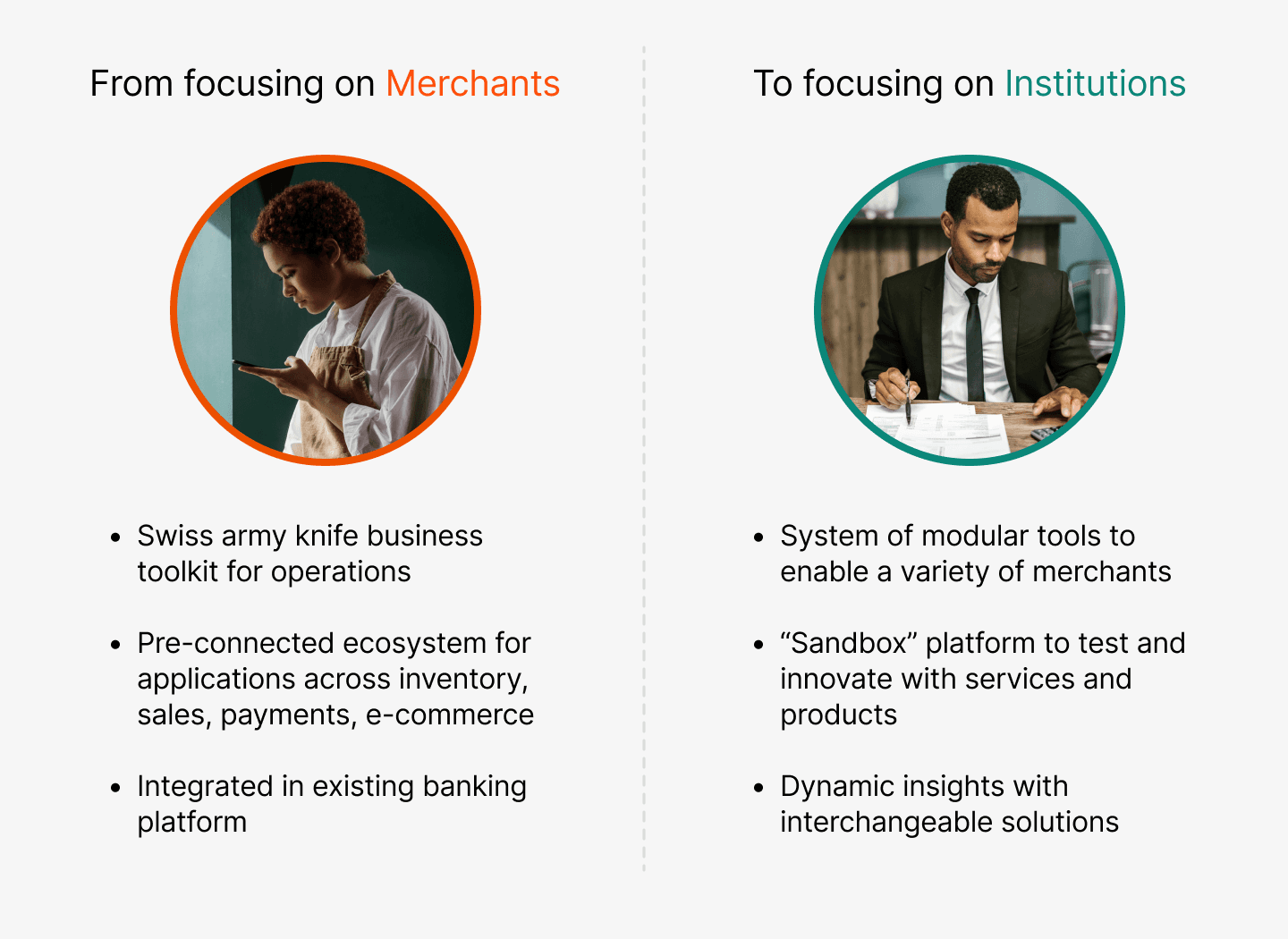

To truly move the needle for local merchants, littlefish's messaging needed to deeply resonate with those pivotal to their success: the financial institutions

To truly move the needle for local merchants, littlefish's messaging needed to deeply resonate with those pivotal to their success: the financial institutions

To truly move the needle for local merchants, littlefish's messaging needed to deeply resonate with those pivotal to their success: the financial institutions

Diving deep

Diving deep

Diving deep

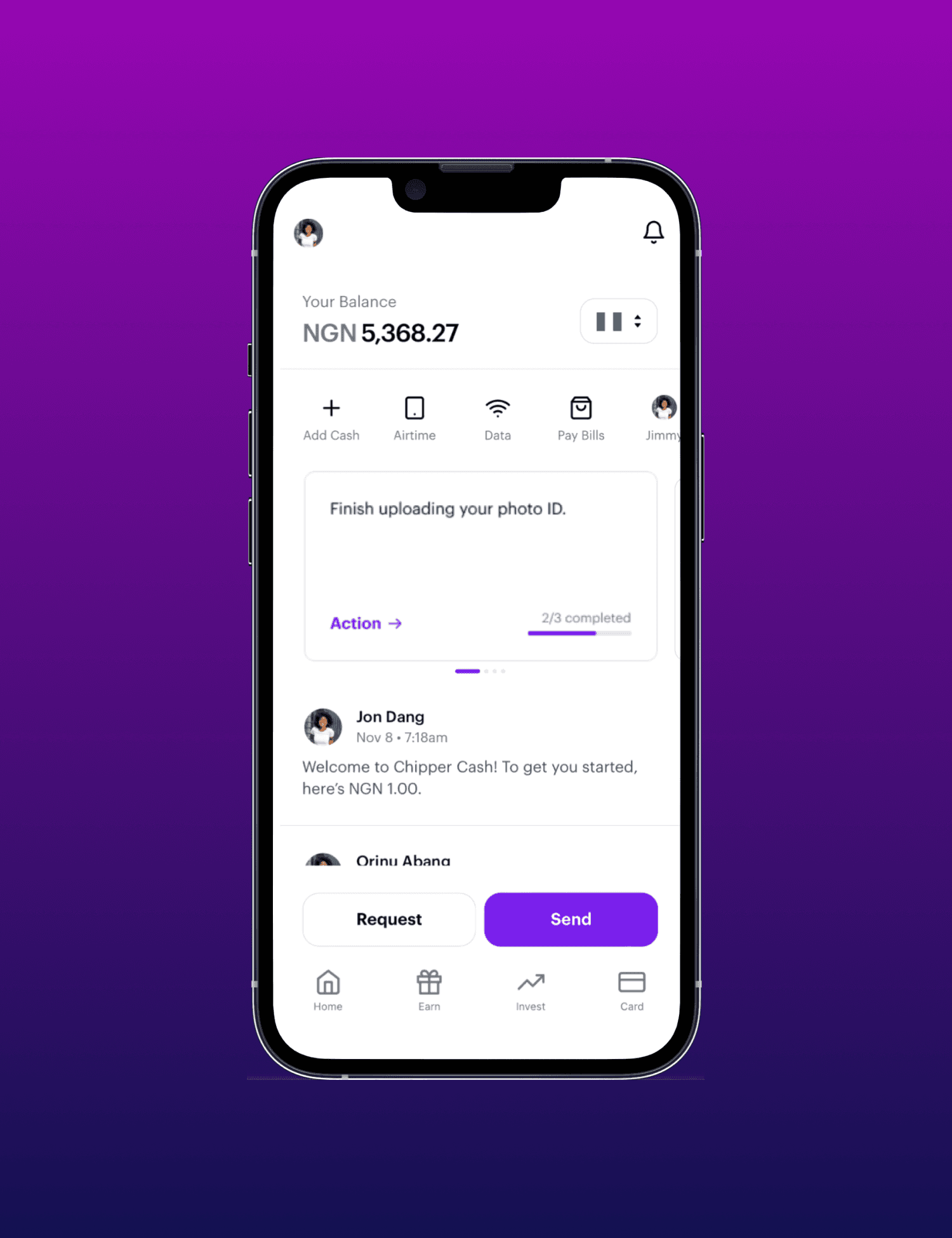

After intensive discovery and strategy sessions, we designed a clear narrative that helped littlefish's partners understand merchant realities, and the urgent need to evolve. As the rapid innovation of fintechs begin to overshadow traditional banks; financial service providers need better products and services that serve their merchant customers - fast.

After intensive discovery and strategy sessions, we designed a clear narrative that helped littlefish's partners understand merchant realities, and the urgent need to evolve. As the rapid innovation of fintechs begin to overshadow traditional banks; financial service providers need better products and services that serve their merchant customers - fast.

After intensive discovery and strategy sessions, we designed a clear narrative that helped littlefish's partners understand merchant realities, and the urgent need to evolve. As the rapid innovation of fintechs begin to overshadow traditional banks; financial service providers need better products and services that serve their merchant customers - fast.

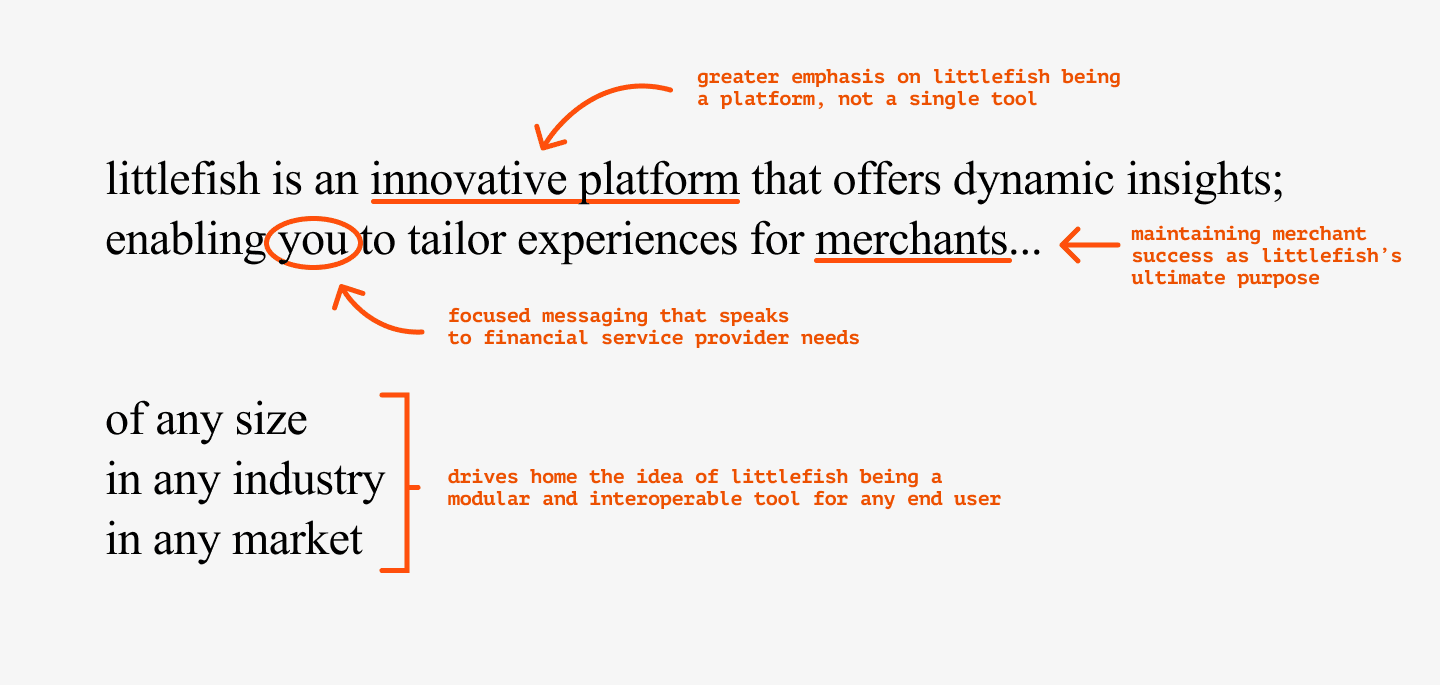

Our collaboration with littlefish led to a pivotal shift in their messaging strategy: acknowledging their primary vision of merchant success, while strategically focusing their messaging on the needs of FSPs.

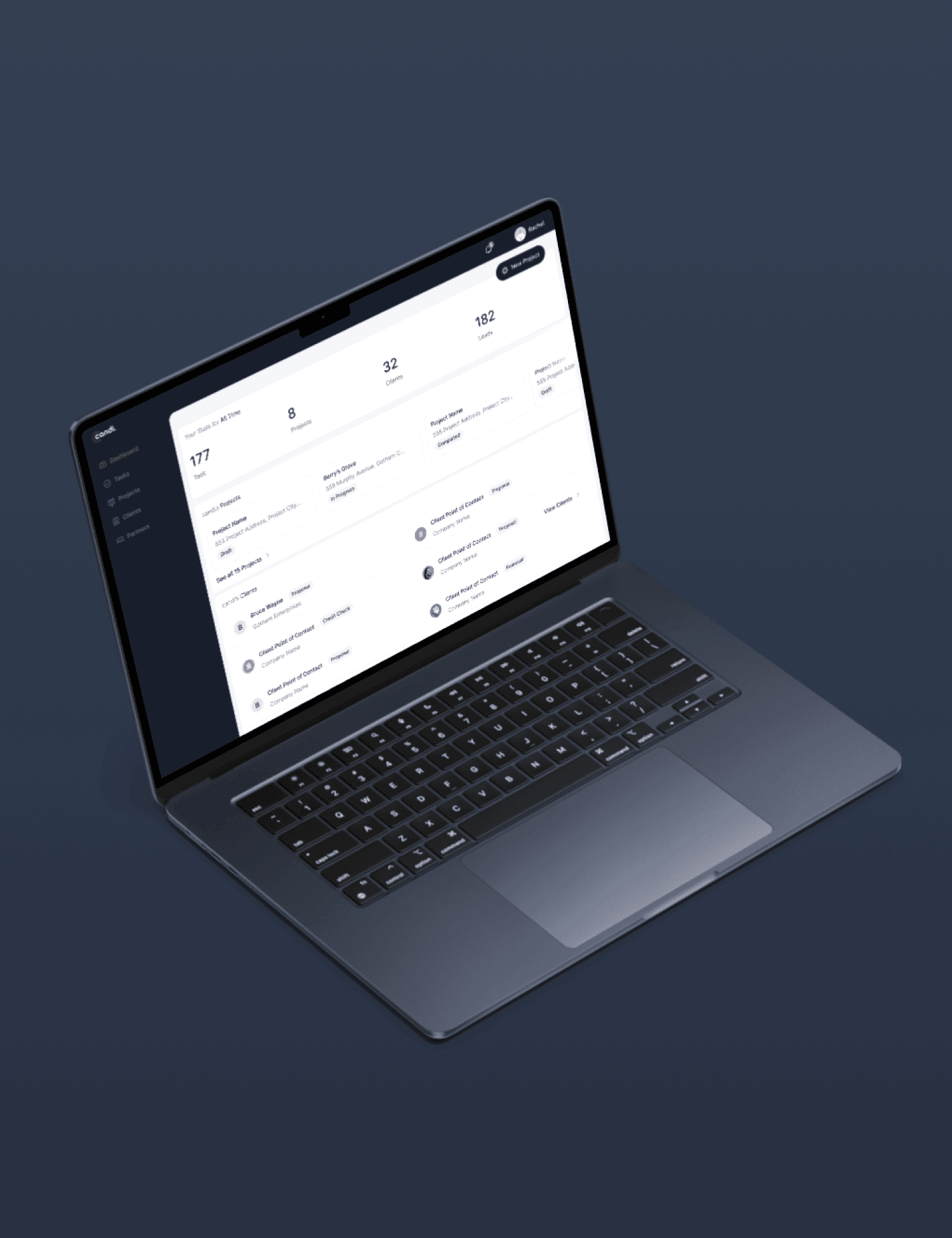

An overhaul on content strategy, visual models, stakeholder mapping strategies drove home the urgent solution that littlefish's technology provided. For merchants tired of switching between business applications, littlefish's single platform with a network of pre-integrated tools meant more time to dedicate toward revenue generating activities, and more reasons to stay loyal to their banking provider.

An overhaul on content strategy, visual models, stakeholder mapping strategies drove home the urgent solution that littlefish's technology provided. For merchants tired of switching between business applications, littlefish's single platform with a network of pre-integrated tools meant more time to dedicate toward revenue generating activities, and more reasons to stay loyal to their banking provider.

An overhaul on content strategy, visual models, stakeholder mapping strategies drove home the urgent solution that littlefish's technology provided. For merchants tired of switching between business applications, littlefish's single platform with a network of pre-integrated tools meant more time to dedicate toward revenue generating activities, and more reasons to stay loyal to their banking provider.

A transformation of littlefish's brand identity and positioning: one that emphasizes their technology's key innovation - and speaks to the key stakeholders in the market.

“Within 3 months we had not only socialised our new position, we had launched it and the market response has seen rapid growth in our business, massive uptake in our qualified pipeline, and our internal product teams have never been clearer on what we’ve set out to create.”

Brandon Roberts

CEO

“Within 3 months we had not only socialised our new position, we had launched it and the market response has seen rapid growth in our business, massive uptake in our qualified pipeline, and our internal product teams have never been clearer on what we’ve set out to create.”

Brandon Roberts

CEO

“Within 3 months we had not only socialised our new position, we had launched it and the market response has seen rapid growth in our business, massive uptake in our qualified pipeline, and our internal product teams have never been clearer on what we’ve set out to create.”

Brandon Roberts

CEO